In this blog, we will talk about a few common myths Investors in India hold. Not only are these myths widely spread and believed by many but are often presented with biases. We will debunk 3 myths with facts, data, and real-world insights. Usually, such myths are created by financial product sellers and marketers for their benefit. And the people who follow such investment advice not only expose themselves to unnecessary risk but also tend to make less return on their investment.

Table of contents:

- Investment Myth 1: Real Estate Investment Guarantees wealth growth.

- Investment Myth 2: Gold is a foolproof wealth protector.

- Investment Myth 3: High-Risk Investment Guarantee High Returns.

- Conclusion

Investment Myth 1: Real Estate Investment Guarantees wealth growth.

Real Estate for decades has been the most preferred asset class for investment in India and worldwide. Real Estate is perceived to be safe, risk-free, stable, and a mode of wealth growth by investors. These are some common investment myths we have with real estate. But all that we have known and have been told by many, stand true? Let’s find out –

Real Estate Investment has some major issues:

- Low liquidity: Real Estate investments are low on liquidity; investors can’t cash out the investment whenever they want to. Investors never have the surety of property getting sold in a defined time. Often Investors hire brokers who find buyers and finalize the deal and act as a middle man taking roughly 1-2% commission.

- High Interest Rate vs. Low Growth Rate and Rental Yield: In India real estate financing is expensive compared to other countries like Indonesia where the interest rate is lower and the return on real assets is greater compared to India. In India when we talk about home loans the interest rate lies between 8-12% whereas the return from the last decade on residential property has been around 4-5% mainly for urban real estate. the rate of return may be high for land parcels. Also, things could be different when looking at selective properties and locations. There are always exceptions but the argument lies in the context of general phenomenon.

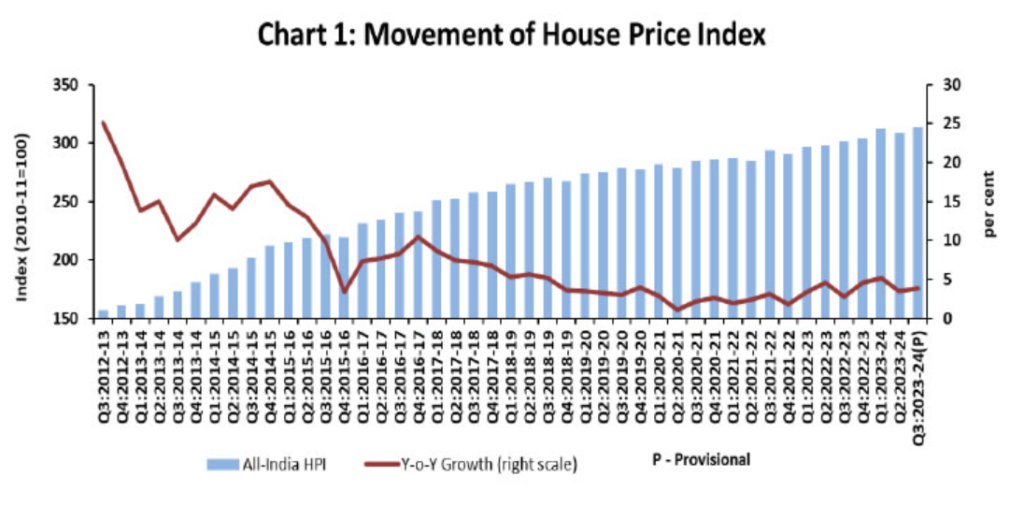

- Volatility: Real Estate investors often perceive that real estate is not volatile and has a stable growth rate. But it is not true, Real Estate as an asset class is volatile and is influenced by factors like Fluctuating Returns, City-Specific variability, Economic Events, Regulatory Changes, and many other factors. Looking at the last few decades, market returns were very robust during 2010-2015 but after that returns fell to 5.5% from 2015-2020, worse during the COVID period, and again in 2024 the market seems to have recovered in many aspects. Events like Demonetization and Covid-19 have caused significant disruption in the real estate market. When we talk about different city-specific variables, Last decade Lucknow had around 16% return per year vs 6.1% return per year in a city like Jaipur. These examples and facts show us the volatile nature of real estate. The numbers and examples around it completely debunk the investment myth that real estate is a stable investment and is not volatile.

- Maintenance and Taxes: Maintaining real estate and Taxes just add up as a cost to the real estate investment which kills the return even further.

Real Estate has some advantages like:

- Tangible Asset: Real Estate being physically available to investors gives a sense of security and ownership.

- Steady Income: The owner can have a steady rental income through their residential or commercial property, even lands can be leased.

- Appreciation Potential: Real Estate can appreciate over a longer period if they are in the right location.

Return on a real estate property in cities like Delhi, Mumbai, and Bengaluru on average has been around 4-5% per annum at max keeping up with consumer price inflation.

See how real estate has performed over the past decade:

Source: RBI

When real estate compared to equity over 20 years from 2003-2023, equity would have given 17.2% CAGR vs 9% CAGR in real estate. For 10 Year period from 2013 to 2023, Equity would have given 13% CAGR vs 5% CAGR in real estate.

Investors must understand that Real Estate is no longer an investment mainly in cities like Delhi, Mumbai, and Bengaluru. Is it possible to make money through Investing in real estate? Yes, lands are still a good option to invest, Few localities, a few projects, and investment at the right time will fetch great returns. But real estate market research is not easy, relevant data are not easily available and a lot depends upon the predictability based on assumptions of one own knowledge, making it even more difficult. Real estate like land has many other issues like Land encroachment. House prices in India are overvalued compared to many developed and developing countries.

Investment Myth 2: Gold is a foolproof wealth protector

For generations, gold has been seen as a wealth preserver and a method to protect wealth during economic downturns. But this is neither true nor false. There are other factors that an investor should consider.

Indian families have their 2nd highest asset allocation in gold after real estate. Which reflects the high conviction and trust people have in their gold investment. But most Indian households have gold in the form of jewellery which should not be seen as a gold investment (We will discuss it in some other blog). We will see how Gold has performed against equity and also we will see some of the demerits of gold and at the same time will debunk common investment myths attached to Gold.

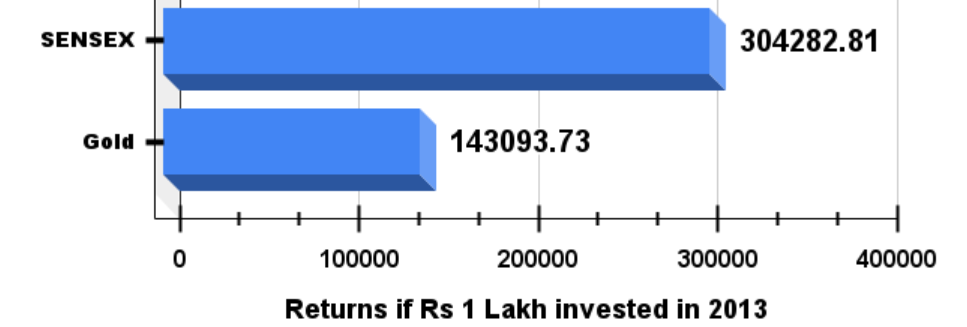

GOLD vs Equity (SENEX & NIFTY)

Source: Maitra Commodities Pvt. Ltd

The above graph shows us a practical return when 1 lakh was invested in SENSEX and GOLD in 2013 and their return in the year 2021. Not only did SENSEX surpass gold in return but also did with a huge margin. Over 10/20/30 years when we compare SENSEX and Gold Returns, SENSEX has always outperformed Gold. Over the past 10 years from 2010-2020, gold has achieved a Compound Annual Growth Rate (CAGR) of 9.2%, compared to the SENSEX’s 10.5%. Looking at 20 years from 2000 to 2020, gold has delivered returns of 12.7% CAGR, while the SENSEX has posted a 15% CAGR. Similarly, over 30 years from 1990 to 2020, gold has returned 9.3% CAGR, in contrast to the SENSEX’s 14.8% CAGR.

NIFTY vs GOLD YoY basis:

Source: MoneyControl

When we compare the YoY basis we can see the volatility in both asset classes, but gold is safer and less risky compared to an equity investment. Observing the above table we can see that from 2005 to 2024 gold has only 6 times outperformed NIFTY returns, overall NIFTY in the long term has outperformed gold.

Cons of owning Gold:

- Volatility: Gold prices are very volatile and are influenced by many factors including geopolitics, currency fluctuations, and due to interest rate changes.

Source: BarChart

The above chart of GOLD VIX shows the last 1 year of Gold ETF Volatility. For example, during economic uncertainty, gold prices rise and during the economic recovery, gold prices tend to correct. But overall, they have upward trends.

2. Lack of Income Generation: Gold doesn’t generate any sort of income unlike dividend-paying stocks and rental real estate do. Over the long-term dividend-paying stocks and bonds have given better returns than gold.

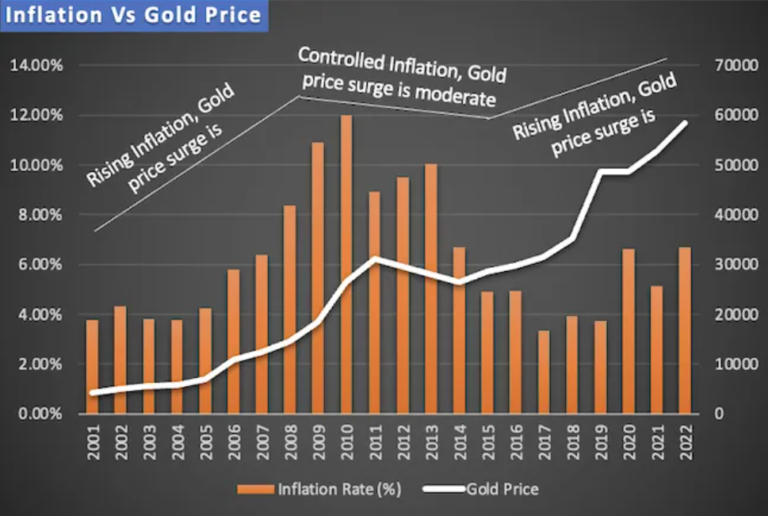

3. Inflation Hedge: Often Investors view Gold as a hedge against inflation. But it’s not always true, its performance when seen as an inflation hedge has been inconsistent. During some periods of high inflation gold prices have increased, but in others, it had at max kept the same pace as inflation. Below is a chart showing inflation vs gold performamce:

While gold can be a great asset class for diversification, but there are other asset classes that perform better than gold which investors should consider. And as we saw above gold is not a foolproof wealth protector. With its high volatility nature, lack of income generation capabilities, and inconsistency in performance as an inflation hedge it’s better for investors to look at gold with a balanced perspective.

Investment Myth 3: High-Risk Investment Guarantee High Returns

Most investors especially new ones, often enter the market with very high expectations and they think if they make risky bets, they will eventually make big returns. Inspired by half-baked-up stories and dialogues like “Risk hai toh Ishq hai” and eventually end up losing tons of money. They choose either asset classes like Cryptocurrencies or enter into speculative stocks without proper due diligence. So we will discuss what can go wrong with such ideology and debunk the investment myth with facts and data.

Cons of High-Risk Investments:

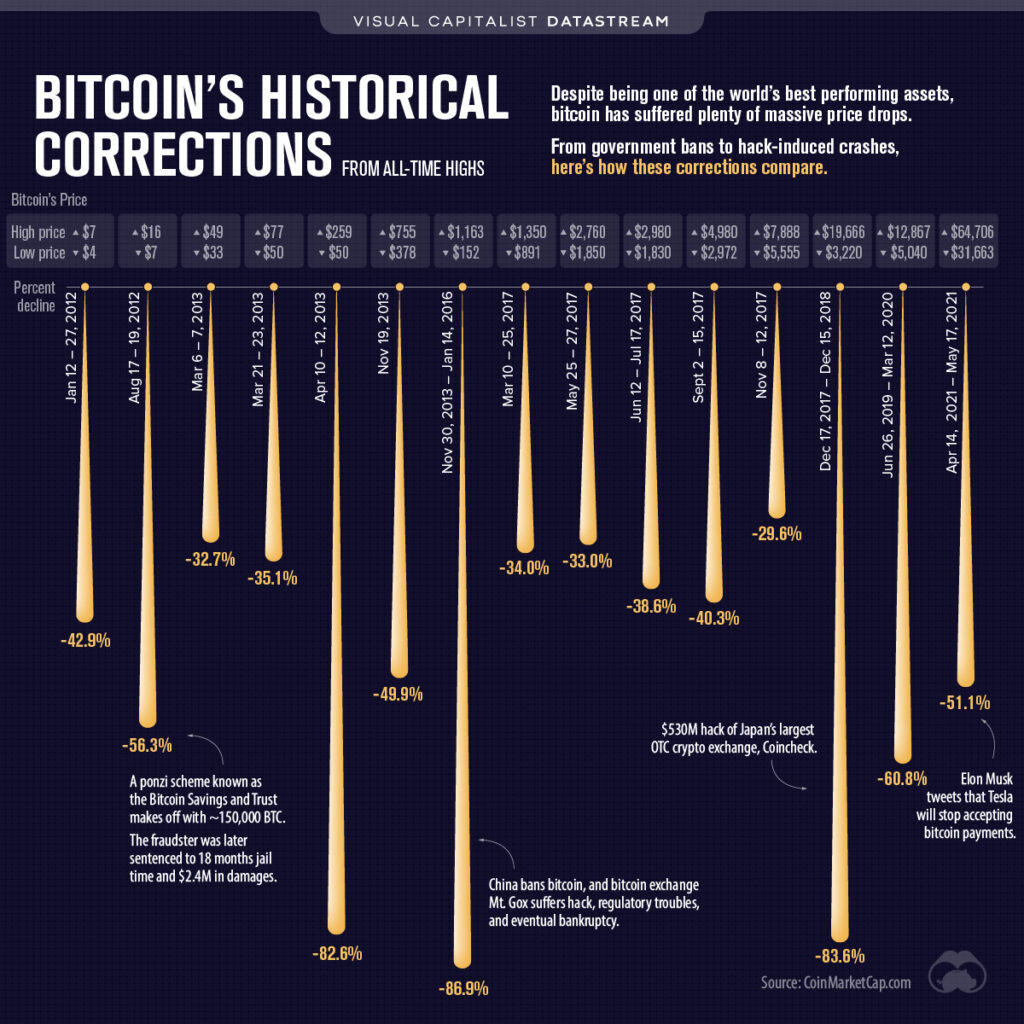

Cryptocurrency: Highly Volatile, only a few cryptocurrencies are legit, and 99.9% of others are just pump-and-dump schemes. Even currencies like Bitcoin and Ethereum have insane volatility. Regulatory risk is another major risk associated with such asset class, creating uncertainty about investment existence.

For example, Bitcoin’s price fluctuated between $40000 and $70,000 in the first half of 2024 alone. Because of economic uncertainty, and regulatory tightness around cryptos around the world. Old chart below which will give investors an Idea of Bitcoin’s volatility:

Source: VisualCapitalist

Speculative Stocks: Speculative Investments are one of the riskiest bets with the potential to give high returns but at the same time investors can incur heavy losses. Often speculative stocks are new companies that promise high growth potential with a limited history or track record of doing so. So they can either be zero to hero or they remain to be a zero for investors. Investors invest in future growth rather than today’s profitability which makes speculative investment risky and volatile. We will see a success and a struggling story to better understand this:

Tesla: Despite market volatility, the stock has performed well for investors creating huge returns. With its continuous innovation and expanding EV market, tesla has been a success story.

Peloton: Investors had high conviction in the company and the growing market the industry operates in, but it continued to face challenges due to a decrease in demand post covid and has performed negatively for investors and is a struggling story.

It is not important to take unnecessary risks to make extraordinary returns. Investors with the right approach, with proper diversification can make good returns by exposing themselves to less risk. One of the most important lessons to learn for any investor is to know how to mitigate risk. Investors can mitigate risk by hedging or diversifying.

Conclusion:

Diversification is the most important aspect of investing, one can diversify with the same asset and among different assets, which will help to deal with unsystematic risk. Understanding the pros and cons of any investment before investing is a must. Investors’ goals need to be clear, when an investor knows what it wants and acts accordingly no asset class is bad. Investing needs a lot of research, consult a financial advisor but don’t trust them blindly doing your due diligence is very important. We have tried to debunk common investing myths in our blog. It might help you gain a different perspective regarding your investment.

Share our blog so more people can get financially literate. Thank You for reading.