Table of Contents:

About KPIT Technologies Ltd.

- History of KPIT Technologies and its Evolution

- Merger and Acquisitions

- Birlasoft and KPIT Merger

- Technica Group Acquisition

- History of KPIT Technologies and its Evolution

- KPIT Technology’s Latest News/Key Updates

- Industry Analysis

KPIT Technologies Moat and Strengths

KPIT Technologies Ltd. Weaknesses and Risks

KPIT Technologies Key Clients/Partners

Financial Analysis of KPIT Technologies Ltd.

Conclusion/Commentary on KPIT Technologies

About KPIT Technologies Ltd.

KPIT Technology is an Indian Multinational Company, headquartered in Pune with Global Delivery & Development Centres across Europe, USA, Japan, and China along with India. This global technology company partners with the automotive and mobility ecosystem to make SDV (Software Defined Vehicles) a reality. In this space, it provides solutions mainly in 7 domains Autonomous Driving & ADAS, Electric & Conventional Powertrains, AUTOSAR, Connected Vehicles, Digital Connected Solutions, Vehicle Diagnostics Solutions, and Vehicle Engineering & Design to its partnered companies.

Services/Products offered by KPIT Technologies Ltd.

KPIT Technology is a global technology company that specializes in IT Consulting and Product Engineering solutions, primarily focused on the mobility and transportation industry. KPIT Technology is known to develop next-gen mobility solutions for its clients and partners across the globe. With continuous innovation in its domain and deep expertise, it provides its clients in the automotive industry with innovative solutions.

All the products/services have been listed down below:

Feature Development and Integration make up almost 66.6% of total revenue. Followed by cloud-based connected services and Architecture and Middleware at 18.5% and 16% respectively

History of KPIT Technologies and its Evolution

KPIT was started by Ravi Pandit (co-founder and chairman) and Kishore Patil (Co-founder, CEO, and MD) in 1990. Interestingly both the co-founders are CA. Ravi Pandit also went to MIT Sloan School of Management. Before Starting KPIT both the founders were partners in an accounting firm Kirtane & Pandit Chartered Accountants (KPCA). After 9 years of establishment in the year 1999 KPIT went public and IPO was subscribed to over 50 times.

Merger and Acquisitions

KPIT just after 3 years of its listing, in 2002 got merged with a USA-based IT company Cummins Infotech and it became KPIT Cummins Infosystems. Actually, Cummins IT arm of India was merged with KPIT, making KPIT Cummins Infosystems a mid-Sized IT Company. Next Year in 2002 KPIT acquired a US-based SAP Firm Panex Consulting Inc. In the Year 2005 KPIT acquired two more firms one was SolvCentral.com and Pivolis.com. Again, in the year 2006, KPIT acquired an automotive electronics and software company CG Smith Software Private Ltd. In 2008 KPIT acquired Harita TVS Technologies Ltd. Later In the year 2009 KPIT Cummins Infosystems went through another merger with a US-based consulting firm Sparta Consulting for $38 million (180 Cr.). In 2013 KPIT Cummins Infosystems’ name was changed to KPIT Technologies Ltd. Subject to Cummins reducing its stake in KPIT to focus more on its manufacturing business.

Birlasoft & KPIT Merger

In 2019 Birlasoft and KPIT went through a Merger and Demerger Deal. The CK Birla Group-owned Birlasoft was first merged with KPIT Technologies. And then the entity was demerged into two different companies – One is Birlasoft the IT Service company and the demerged entity is KPIT Engineering which was again renamed as KPIT Technologies Ltd. The Merged IT service entity was valued at $500 million in 2019 and the demerged KPIT engineering was valued at $200 million.

Technica Group Acquisition

Recently In the year 2022, KPIT acquired 4 of the Technica Group Companies for €80 million (approx. ₹640cr.) The Four Companies which were acquired by KPIT Technologies were:

- Technica Engineering Gmbh, Germany

- Spain and Technica Engineering Spain S.L., Spain

- Technica Electronics Barcelona S.L., Spain

- Technica Engineering Inc, USA (Acquisition through KPIT Technologies Inc, USA)

Both KPIT Technologies GmbH and KPIT Technologies Inc, USA are 100% wholly owned subsidiaries of the Company of 100% shareholding.

KPIT Technology’s Latest News & Key Updates

- Joint Venture Investment agreement has been approved. JV between KPIT and ZF Friedrichshafen AG to invest in a currently 100% KPIT subsidiary, Qorix GmbH. Qorix GmbH focuses on automotive middleware.

- KPIT FY24 revenue growth at 40% and PAT growth at 56%.

- KPIT Technology partners with Microsoft Azure Open AI for Its vehicle diagnostic platform Trace2Fix. Trace2Fix is equipped with an LLM model for accurate diagnosis which will help in identifying root causes in complex vehicle systems. It will also increase customer retention and enable technicians to operate better.

- Last Year 2023 December KPIT unveiled indigenous-developed sodium-ion battery technology which can be a great alternative to lithium-ion batteries. Sodium-ion batteries have faster charging capability and extended lifespan compared to lithium-ion batteries.

Industry Analysis

Industry Overview:

To understand KPIT Technology Business which is very niche to Automobile IT Software. We must look at the automobile and IT sector as a whole rather than just focusing on IT.

IT Software Industry Overview:

In FY23-24 the IT software Industry contributed around 7% to India’s GDP. Indian IT software industry is projected to have revenue of $254 Billion of which almost $200 Billion is through Exports and $54 Billion from the domestic Market. The top Export Destination for Indian Software remains to be the US (62%), the UK (17%), and the EU (11%). The slowdown in all these markets has resulted in Indian IT software exports slowing down. With traditional markets slowing down there is a rise seen in new developing markets like Latin America, Japan, Africa, and Asia Pacific. The market is estimated to grow at a double-digit of 13-16% once the market recovers and gets back to its full potential internationally. India’s IT industry is very likely to hit the $350 Billion mark by 2026, contributing 9%-10% to India’s GDP.

Source: Meity

Automobile Industry Overview:

Indian Automobile Industry contributes 7-7.2% to India’s GPD and has a 4.7% share in India’s exports. The automobile Industry produced around 25.93 million vehicles from April 2022 to March 2023. January 2024 saw highest highest-ever sales of passenger vehicles in the month of January growing at 14% to 3,93,074 passenger vehicles compared to January 2023. Indian Automobile passenger vehicle market was valued at $32.7 Billion in 2021 which is estimated to reach $54.8 Billion by 2027.

As KPIT technology focuses its business on developing technology and providing software services to EV vehicles a lot, The EV market alone is expected to grow at a CAGR of 49% from the year 2022-30. The electric EV market to expected to reach $7 Billion (INR 50000 crore) by 2025. Also, 100% FDI Investment is allowed in the Indian Automobile Industry.

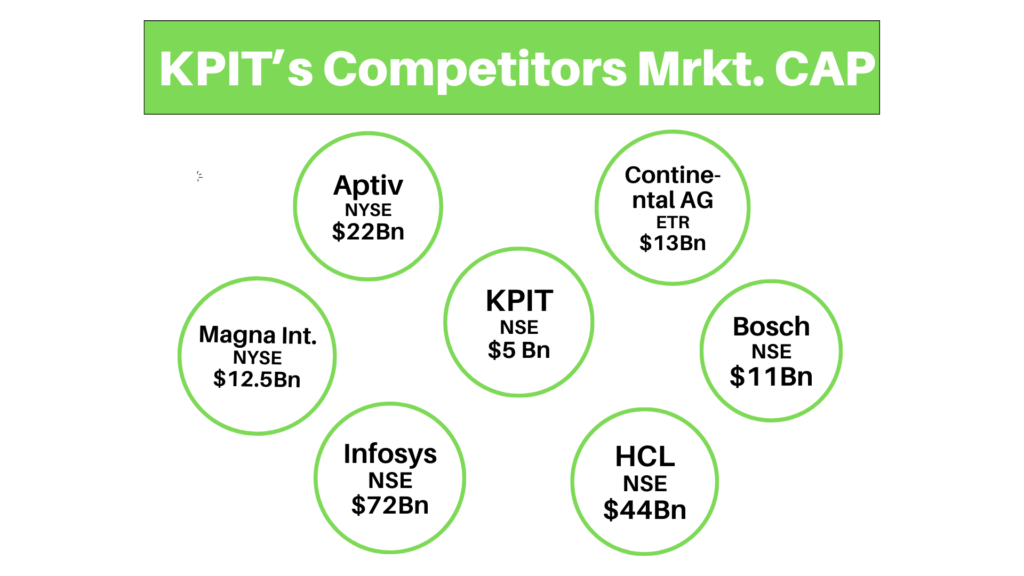

Industry Competitors for KPIT Technology

We will be looking at a few competitors some may be startups and some are publicly listed companies.

- Bosch Mobility: It provides services that are very similar to KPIT which includes embedded software, autonomous driving systems, connected mobility solutions, and powertrain solutions. It has a very big presence in ADAS technology and IoT solutions.

- Continental AG: It is a German Multinational company that specializes in technology around Mobility. Key services and products include Autonomous Mobility, Electric Mobility, and Vehicle Connectivity.

- Harman International (A Samsung Company): It specializes in connected car solutions, Software-defined vehicles, TaaS, and Software Integrator Services. It competes with KPIT Technologies as many services and products we believe few overlaps and both have similar client tale we see it as a competitor.

- Aptiv Technology: This is a company very similar to KPIT listed in NYSE. Aptiv is a pure-play Mobility Technology company that has products and services very similar to KPIT and operates in the same Industry.

- Magna International: Listed in NYSE, a company that has many products and services and primarily focuses on Mobility Tech. It offers engineering and software solutions for electrification ADAS and Connectivity.

- Infosys, Wipro, HCL: Listed in NSE and BSE, these Indian IT companies provide all kinds of services and solutions, including autonomous driving technologies solutions. However, I don’t see it as a direct competitor to KPIT.

One thing we need to understand is they are competitors but often KPIT Technologies has collaboration and partnership with a few of these firms and they work on some of the common projects.

KPIT Technologies Moat and Strengths

First, let’s understand what is a “MOAT” in a Business.

“MOAT” refers to any competitive advantage that a company has in the business that creates a barrier to entry for others. A business with a Strong MOAT will make it tough for its competitors to replicate its success. MOAT can be a lot of things like Strong Brand Value, Unique Products & Services, Patents, proprietary technology or process, the scale of business, or anything that makes it tough for competitors to surpass the company’s success.

MOATs of KPIT Technologies

1. Innovation & Technology: As we have seen above KPIT has a wide range of Innovative Solutions for the Automotive Industry. It works in 7 Key domains and has strong expertise throughout all those domains. KPIT provides end-to-end solutions and services for most of its offerings. KPIT innovation helps its client improve efficiency, improve existing technology, reduce cost, and enhance their operations.

According to KPIT’s 2021 Annual Report, the company spend invested around 6.4% of its total revenue in R&D. 6.4% converts to approx. $8.5 million which shows the company’s approach toward continuous innovation. KPIT has a team of highly qualified researchers with great industry experience and Ph.D. holders. KPIT also has established many research and innovation centers and labs dedicated to specific areas of R&D. This continuous research and innovation create a MOAT for KPIT.

2. Global Reach: KPIT Technologies is truly an MNC with global reach with its presence in 18 countries and customers in more than 30 countries. It has a presence all across US and Europe with multiple offices. In the US it has offices in 3 major cities Michigan, Texas & California. In Europe, it has its presence in the United Kingdom, France, Germany, Sweden & Spain. It also has a presence in the Asia Pacific region in countries like India, Japan & Singapore. KPIT is also rapidly trying to Increase in presence in the middle east by establishing its offices in Dubai and Saudi Arabia. This kind of global reach helps KPIT Technologies to leverage its expertise and capabilities across different geographies and Industries eventually giving it a competitive advantage.

3. Strong Partnerships: KPIT Technologies has created strong partnerships with companies like Microsoft, SAP, PTC, etc. which allows KPIT to leverage its expertise and give better innovative solutions to its clients. KPIT has not only partnered with leading technology corporations but also with academic Institutions like IIT Bombay and IISC Bangalore. Also, KPIT is member of many Industry associations including the Society of Automotive Engineers (SAE), the International Council on Clean Transportation (ICCT), and many more. Recently KPIT Joined hands with Vehicle Computing Consortium (AVCC) to bring further development in Autonomous Driving & ADAS.

4. High customer retention: KPIT Technologies’ high customer retention shows the company’s ability to deliver high-quality solutions and top-notch service to its clients. It is possible because of KPIT’s continuous innovation with time and high business ethics. Some of the partnerships are decades-long and this shows client reliability in KPIT’s solutions and services. KPIT works very closely with its clients to solve clients’ specific problems by understanding the business and providing services accordingly.

KPIT Technologies Ltd. Weaknesses and Risks

We all saw the MOATs of KPIT Technologies, and now we will understand possible threats to the business of KPIT Technologies.

1. Key Clients: KPIT Technologies Dependence On a Few Key Clients is one of the major risks which I feel can be a possible threat to its business in the future. KPIT’s major portion of business comes from a few selective clients, losing one of such clients can be a huge loss to the business. But KPIT is continuously working on this by expanding its geographical reach to expand its clients’ portfolio. KPIT with its continuous innovation is working towards increasing its services and offerings to cater to a wider range of clients. Also, to work fast on this problem or Risk KPIT is acquiring business all across the world. But the fact can’t be ignored that KPIT’s few clients still contribute to a major portion of the business.

2. Competition: The industry is very competitive with big players like TCS, Infosys, Accenture, Aptiv, Magna International, Harman International and many more who are providing similar services and solutions. Some Competitors in this market may have better market reach and service offerings. To tackle this issue KPIT Technologies focuses on now more niche markets like Autonomous and connected vehicles, Clean green technology, digital transformation & unique industry services which KPIT brings through continuous R&D. Being in the niche market also helped KPIT to develop incredible industry and domain expertise.

3. Regulatory Risk: KPIT is not the only company that has regulatory risk but we will see what specific regulatory risks KPIT may face and how KPIT is overcoming those risks. Majorly regulatory risks come from regulatory bodies and laws that govern this industry all around the world. KPIT needs to keep its clients’ data safe and secure and must comply with various regulatory and data protection regulations like GDPR, CCPA, and HIPAA. Non-compliance with any of these can result in penalties, a bad reputation in the industry, and loss of valuable clients. KPIT Technologies’ business relies a lot on its Intellectual Property and proprietary software to deliver service to its clients so the company also needs to protect its IP Rights. To keep all these things in a control compliance program that makes sure everything is under compliance with applicable laws and regulations.

4. Key Employees: KPIT Technologies depends a lot on retaining and acquiring employees who have years of experience and expertise in the IT service sector for its 7 key business domains. Failing to retain such key employees can affect KPIT business very negatively as these employees will create a knowledge and expertise gap in the company. Also, these key employees over the years have built close relationships with clients, when such key employees leave there is a possibility of losing clients too.

To mitigate these risks KPIT has created proper succession planning which gives employees great growth potential and career progression also KPIT offers a competitive compensation package to its key employees. They have also built knowledge management which makes sure of proper documentation of sharing knowledge and expertise among employees.

KPIT Technologies Key Clients/Partners

BMW, Daimler (Mercedes-Benz), Ford, General Motors, Volkswagen Group (including Audi, Porsche, etc.), Fiat Chrysler Automobiles (FCA), Renault, Nissan, Hyundai, Toyota, Maruti Suzuki, Volvo, Honda, Jaguar Land Rover.

These are some of the automobile companies that have been in collaboration with KPIT Technologies for mobility solutions.

Key Partners:

- NVIDIA: AI-based solutions for Autonomous Driving and In-Vehicle computing platforms.

- Microsoft: For cloud-based solutions.

- Intel: For embedded Systems

- IBM: For AI and Cloud Computing Systems

*Client list is what we were able to find from multiple different sources this is not complete or can have a few wrong additions, list but for sure can give you an idea about the client portfolio.

Financial Analysis of KPIT Technologies Ltd.

Let’s now go through the financial position and health of KPIT Technologies Ltd. While doing a fundamental analysis of business we won’t dive deep into forensic financial statements but will be looking at key values.

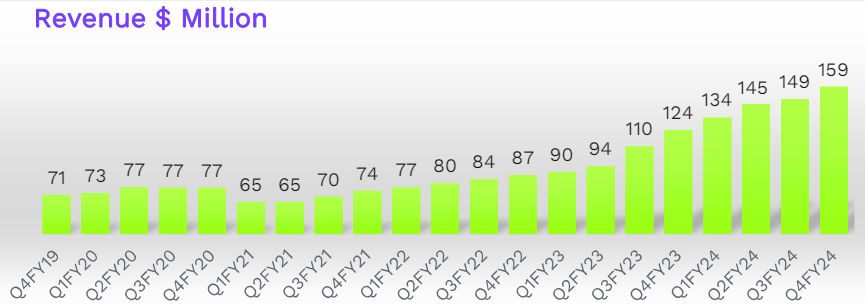

Revenue Growth:

Revenue has been consistently growing at a rapid pace post covid.

Revenue for FY23-24 stands at $587Mn compared to $418.3Mn in FY22-23. It is showing approx. 40% YoY growth. And Revenue growth has been 6.6% QoQ. In the last 3 years, revenue Growth has been 33-34%. And the company expects revenue to grow in the range of 18-22%.

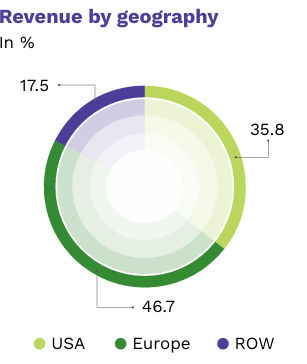

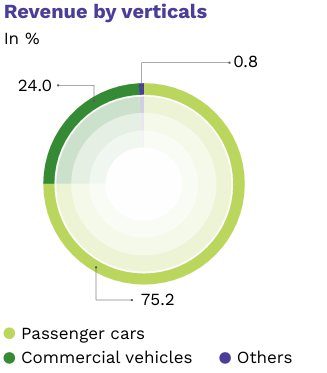

Revenue by geography & Verticals:

USA is the biggest market for KPIT Technology which contributes 46.7% of total revenue and has 20.7% YoY growth. Followed by Europe which contributes 35.8% of total revenue and has 56.5% YoY growth. The remaining 17.5% of revenue comes from the rest of the world.

Passenger Vehicles segment constitutes the largest share in KPIT’s Revenue, making up 75.2% of total revenue. The passenger vehicle segment is growing at 44.1% YoY. Followed by Commercial Vehicles which make up 24% of total revenue and it is growing at a pace of 11.1% YoY.

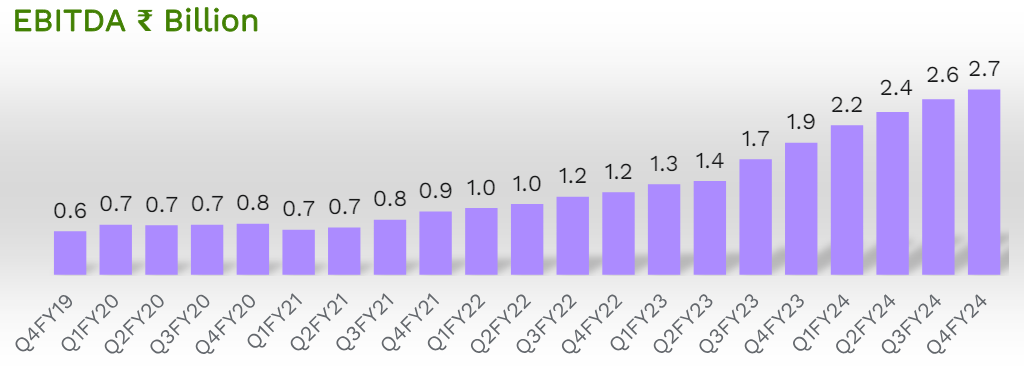

EBITDA:

EBITDA has been consistently growing for KPIT Technology which is a good sign. EBITDA Margin stands at 20% as of FY24 and is expected to maintain 20%+ EBITDA margin for the year FY25. EBITDA grew by 40.5% YoY basis and 5.8% QoQ basis.

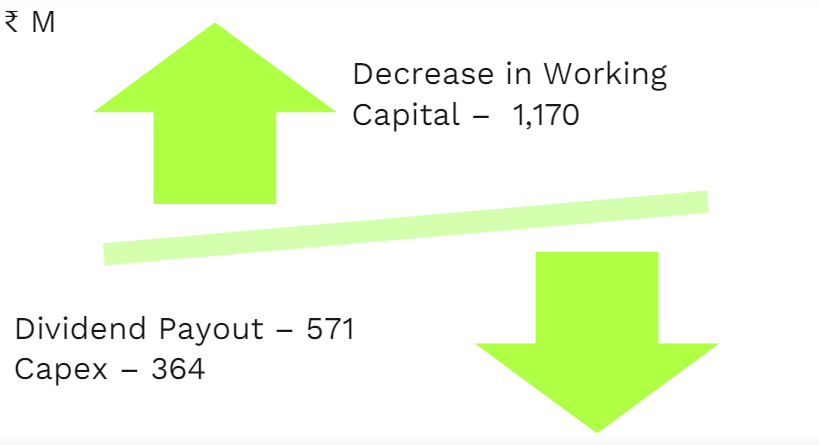

A decrease in working capital by INR1170 Million, indicating a positive effect on cash flow means the company has freed up cash possibly reducing Inventory, receivables, or by increasing Payables.

KPIT has increased its dividend payout to 571 crores showing an Increase in cash outflow. And Increase in Capex to 364 crores for the FY24.

Source: KPIT Investor Update

Key Financial Ratios:

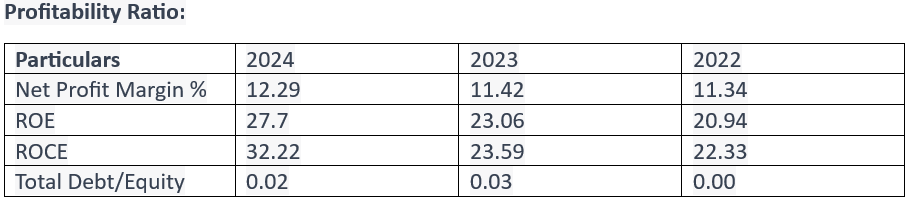

KPIT Technology has shown a constant trend of improvement in its profitability ratio. The NPM % has been constantly improving and is projected to improve further. High ROE is always good this shows that the company is using its equity base to efficiently generate profits and maximize shareholders’ value. ROCE has shown the highest improvement in the year 2024 it shows that the company is using capital efficiently and reflects strong improvement in operational performance. Low Debt to Equity reflects less reliance on debt capital and a low degree of Financial Leverage.

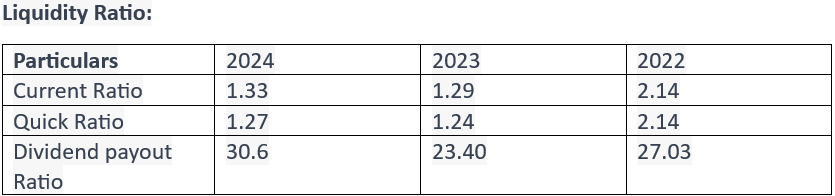

KPIT technology has seen a fall in liquidity ratio from 2022 to 2023 but had a slight improvement in the year 2024. Despite the decline, the ratio remains above 1 which is a good sign that the company won’t have difficulty meeting up with short-term obligations.

The dividend payout ratio shows variability, an increase in the dividend payout ratio means the company is distributing a larger portion of earnings as a dividend, which could be seen as a positive sign for investors. But it could also be negative at times which needs deeper analysis.

Conclusion/Commentary on KPIT Technologies

As of now, I feel like the stock is trading at a premium, Stock P/E is currently around 68 which is fairly high compared to its peers. The Company is showing good profitably and revenue growth. Having negligible debt means close to no financial leverage which makes the company’s balance sheet strong. The profitability ratio is constantly improving and is on an upward trend which is again a good sign. The liquidity ratio though has fallen after 2022 they are still above 1 which is positive. KPIT Technologies’ management consists of people with strong domain expertise and seems to follow ethical business practices which is very important for any business. I don’t see any negative as such, though the company has increased participation of retail investors which is something that I see as a negative trait.

The company operates in a very niche business which has its pros and cons but overall, it is in a growing industry that has tremendous potential. The business will be influenced by both IT software and the Automobile Industry.

Disclaimer:

We are not a registered equity research analyst as per SEBI regulations. The views and opinions expressed in this report on KPIT Technology are my own and are provided for informational purposes only. We do hold the stock of KPIT Technology in my personal portfolio, which may influence my views.

This report does not constitute an offer or recommendation to buy or sell any securities. Readers are advised to conduct their own research and consult with SEBI-registered financial advisors before making any investment decisions. The accuracy and completeness of the information provided are not guaranteed, and any reliance on this report is at the reader’s own risk.

Comments 1